Prelude:

Outlook and Valuations:

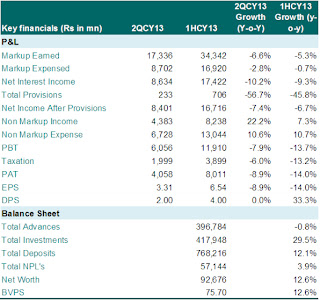

UBL is scheduled to announce its 2QCY13 result on Friday Aug 23, 2013. We expect company to report PAT of Rs. 4.05bn translating into EPS of Rs. 3.31 thus taking 1HCY13 EPS to Rs. 6.54. Along with the re-sult, we expect the bank to announce an interim cash payout of Rs. 2.00/share.

Key quarterly financial highlights:

Decline in bottom line is attributed to lower core income on the back of contracting NIMs, however a robust increase in earnings assets sup-ported the topline from sharp deterioration. Further, lower expected provisioning for this quarter provides a cushion to NII. The bank is likely to post a vigorous growth in non core income primarily due to higher gain on sale of securities which would also hold the impact of declining NII.

Going forward we anticipate a same trend of lower provisioning and improved coverage ratio. We look forward to a consecutive hike in pol-icy rate as a result of fresh deal with the IMF, which ensures a remark-able growth in bottom-line in the years ahead on the back of higher investments. Currently stock is trading at expected CY13 P/BV of 1.70x. Based on our Dec-13 TP of 139.44/share in contrast of yesterday’s closing price of 127.81/share, we recommend a Neutral stance for the scrip.

No comments:

Post a Comment